Automate Payoffs for Turbocharged Results.

In a world where financial stability is often elusive, the dream of homeownership can feel like an unattainable goal. However, we’re here to unveil a game-changing tool that not only makes your dream home a reality but also helps you save a whopping $50,000, $100,000, $200,000, or more! Welcome to the realm of fully automated debt accelerating.

Set It, Forget It: Same Monthly Payments.

Our fully secure and patented solution takes the guesswork out! You’ll be on a seamless and efficient journey to financial freedom where your monthly payment stays the same, but you’ll pay off your home and all other debts in, on average, 11 to 15 years less while saving $1000’s in wasted interest. Sound to good to be true? Read on!

Please watch the video, then read on for additional benefits.

Remember, your dream home is not just a possibility – it’s a financial reality waiting to be unlocked with the right tools.

Advantages of Automatic Debt Acceleration

- Accelerated Debt Repayment: Our fully automated tool leverages the debt snowball method, focusing first on your smallest debts. This strategy not only boosts motivation with quick wins but also frees up funds faster for your mortgage payments.

- Improved Credit Score: Clearing debts step-by-step can significantly boost your credit score, opening the door to better mortgage terms, lower interest rates, and a world of financial opportunities.

- Save Thousands $$$: By targeting high-interest debts early on, you’ll cut down the total interest paid, keeping more money in your pocket for home-related expenses or investments.

- Enhanced Affordability: Reducing your debt improves your debt-to-income ratio, a key factor lenders consider, potentially leading to more favorable mortgage terms.

- Financial Freedom and Peace of Mind: Entering homeownership with minimal debt brings unparalleled peace of mind and a sense of financial freedom.

- Increased Savings for Down Payment: Savings from debt snowballing can beef up your down payment, potentially lowering your future mortgage payments.

- Streamlined Budgeting: The discipline of debt snowballing sharpens your budgeting skills, invaluable for managing homeownership costs.

- Long-Term Financial Wellness: This approach sets you on a path of financial health, enriching your homeownership journey.

- Positive Financial Habits: The debt snowball method fosters habits of financial prudence that pay dividends long after the mortgage is settled.

- Opportunity for Investment: With a healthier financial standing, you’re better positioned to explore further investments for wealth building.

In essence, harnessing the power of debt acceleration not only facilitates the dream of homeownership but also lays a solid foundation for lasting financial well-being.

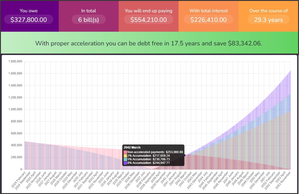

Example: Save $83,000, Pay Off 12 Years Sooner, Same Monthly Payment!

- Total debt $327,800 with 6 monthly bills (Home, Auto, Auto 2, Credit 1, credit 2, School)

- You would pay $554,210 over 29.3 years without acceleration

- With this tool, you automatically pay worst debt first and accelerate your pay off to debt freedom while saving $83,342 and 12 years sooner!

Save over $83,000 and pay off 12 years sooner in this example.

Who are we?

We are a Minnesota-based startup tech company in the early launch phase, driven by a passion for innovation and a commitment to transforming the way people interact with finance. Our team is dedicated to creating cutting-edge solutions that address real-world problems, leveraging the latest advancements in technology to deliver impactful and user-friendly products. With a focus on excellence and a vision for the future, we are poised to make a significant impact in the financial and tech industries.

How Much Will You Save? Find Out!

Looking for Participants for Complimentary Trial.

Available to Individuals Planning a Future Home Purchase.

Join us for upcoming small group informational sessions!

Contact us to learn more and secure your spot!